A First American’s Success Strategy…Don’t Just Do Something! Stand There…! Your Personal Titanic…Sugar Highs and ‘Trouble with the Curve’

- July 27, 2016

- Posted by: Stephen Johnson

- Category: Vistage

“Avoiding danger is no safer in the long run than outright exposure. The fearful are caught as often as the bold.”

The First American’s Success Strategy

Benjamin Franklin has been called “The First American.” By any measure, he was clearly one of the most successful people of his or any age. How did he do it? A recent one page INC Magazine Article offers one habit that contributed to Franklin’s considerable accomplishments that you can easily incorporate into your own life. Learn a little bit about the “Five Hour Rule” How could you apply this rule to your life to become more successful?

Don’t Just Do Something! Stand There!

Many CEOs pride themselves on “multi-tasking” or “wearing many hats.” These are signs of failure to delegate (i.e. “lead”), not traits worthy of admiration. CEOs who get trapped doing other than “CEO Stuff” end up stifling their organizations or leaving money on the table when they sell their company. This brief posting from INC’s CEO Project explains why “Great CEOs are Lazy”

Your Personal Titanic

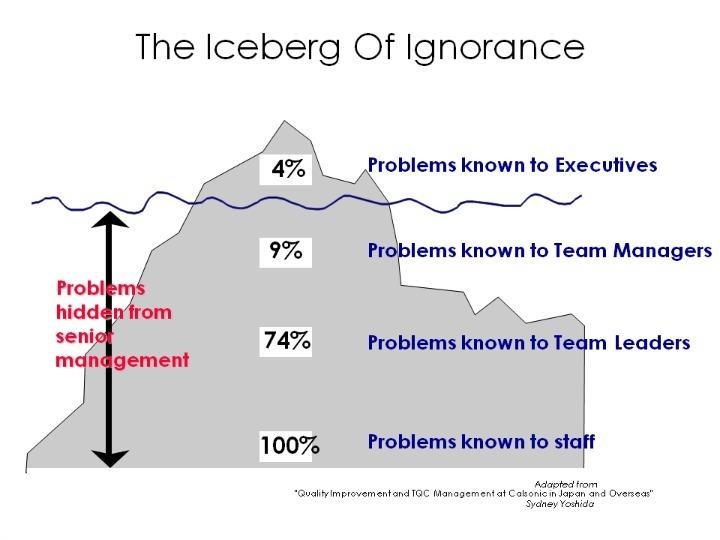

Seven-eights of iceberg’s mass is beneath the surface (remember the Titanic?) The following graphic illustrates what most C-Level executives know about climbing the corporate ladder:The higher you go, the less you know. Will this iceberg sink your ship? What are you doing to uncover what you don’t know about your organization “beneath the waterline”?

Sugar Highs and ‘Trouble with the Curve’

Sugar Highs and ‘Trouble with the Curve’

Equity markets have recently hit new highs and interest rates are low…in Japan they’re negative. What’s happening? In two brief Wesbury101 videos Brian Wesbury explains why he thinks the recent stock market records are not a sugar high, why in the near term equities will outperform bonds, and why interest rates will not go negative (or even drop) in the US in part because the US is still the world’s best credit risk, and because the US has the lowest relative interest rates in the world. He predicts the Fed will start increasing rates soon, but this will not result in an inverted yield curve (which would be a leading indicator for a recession.)